AMC Stock Bid Manipulation:

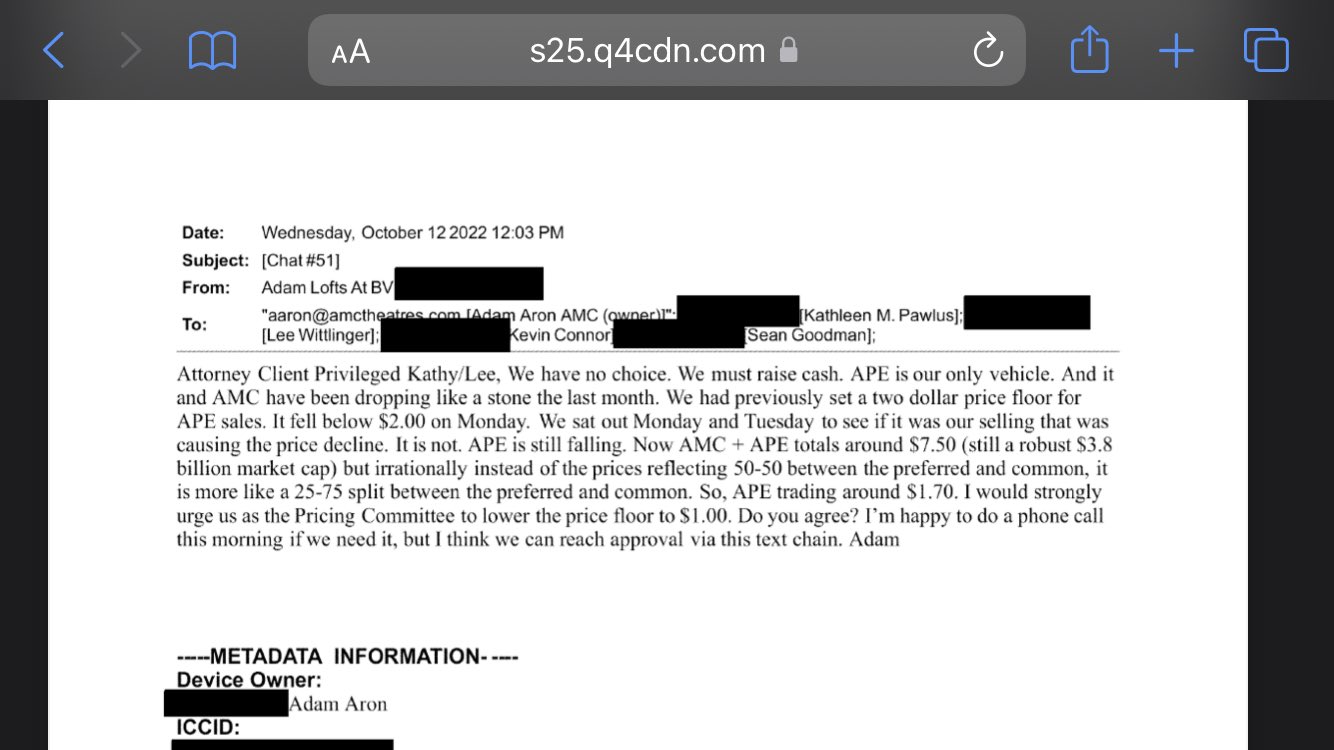

An internal email from the so-called "AMC Popcorn Project Team" sheds light on a concerning trend.

Retail investors observed that the price of AMC stock ($AMC) peaked at $72 per share (equivalent to $720 post a Reverse Stock Split, or RSC) around June 2, 2021. The stock then declined to approximately $32 per share (or $320 post-RSC) by August 3, 2022, just before the introduction of a new asset referred to as "APE."

According to the internal email, the Project Popcorn team wasn't satisfied with merely dragging down the price of AMC by influencing APE. They had been discussing and planning to further devalue APE to their target price of $1, with the intention of causing a corresponding decline in AMC stock.

Fast forward to today, September 1, 2023, and it appears that Project Popcorn has achieved its goal. AMC is currently trading between $11 and $13 per share, which, after accounting for the RSC, is equivalent to $1.1 to $1.3 per share. This represents a significant drop from its peak price of $720 (or $72 post-RSC).

The actions of Project Popcorn raise serious legal and ethical questions, particularly concerning market manipulation, bid rigging, and collusion. Retail investors, who number over 3.8 million in the case of AMC, are now taking steps to independently verify share counts and expose any illegal or unethical activities by Project Popcorn.

This article explores the legality of actions taken by the "Project Popcorn" team and their advisors in manipulating the price of AMC stock. Specifically, it delves into laws concerning bid manipulation, rigging, fixing, suppressing, and collusion.

The Impact of Project Popcorn on AMC and Retail Investors

As of September 2023, Project Popcorn appears to have achieved its goals, with devastating effects on both retail investors and AMC as a company. The stock price has plummeted from its peak of $72 in June 2021 to a mere $1.3, representing a staggering loss of approximately 98.2%.

On August 4th, 2022, AMC common stock (Ticker: AMC) closed at $18.66 (Post Reverse Split Adjusted price of $186.60). The release of the APE share was announced after hours on August 4, 2022. Since the announcement of a new asset referred to as "APE" on August 4, 2022, when the stock was trading around $18.66, the decline has been equally dramatic. The stock has lost about 93% of its value, falling to $1.30 (Post Reverse Split Adjusted Price of $13.30) as of September 1, 2023.

This drastic reduction in stock value has had a significant impact on AMC's retail investor base, which is alleged to number around 3.8 million. If we consider the families of these investors, the number of people adversely affected could exceed 40 million. Project Popcorn seems to have effectively transferred potentially over 90% of the retail investors' initial investments to entities with economic interests that are antagonistic to the well-being of this class of investors.

AMC Retails of over alleged 3.8 Million investors are taking action to count their own shares and expose the Popcorn Projects for the harm it inflected which Retails believe it to be illegal or criminal in nature.